|

Changes in giant squid supply expectations after PeruThe squid market remains stable with minor adjustments, and the price of Argentine Illex squid has declined.

In the 27th week of 2025 (June 27 to July 3), China's squid market as a whole continued the volatile consolidation trend of the previous two weeks. The price of squid from the Southeast Pacific (Giant squid) remained stable, while that from the Southwest Atlantic (Argentine Illex squid) saw a partial decline, and the squid prices in other major producing areas were basically flat.

According to statistics from the Zhejiang Zhoushan International Agricultural Products Trade Center, in the 27th week, the average settlement price of Southeast Pacific squid was 18,866 yuan/ton, basically the same as the previous week. The trading volume reached 5,247 tons, of which the extra-small whole squid (1,926 tons) and small whole squid (1,442 tons) accounted for more than 60% in total, remaining the main specifications in market transactions. In terms of settlement prices, only the squid prices of the two specifications, small squid heads and tail fins, fluctuated, while the prices of other specifications were generally stable. In terms of comprehensive quotations, the quotations for large squid heads and mantles were reduced by 750 yuan/ton and 1,250 yuan/ton respectively, and the quotations for other categories remained unchanged. The market squid price expectation tends to be stable.

Changes in giant squid supply expectations after Peru's fishing ban

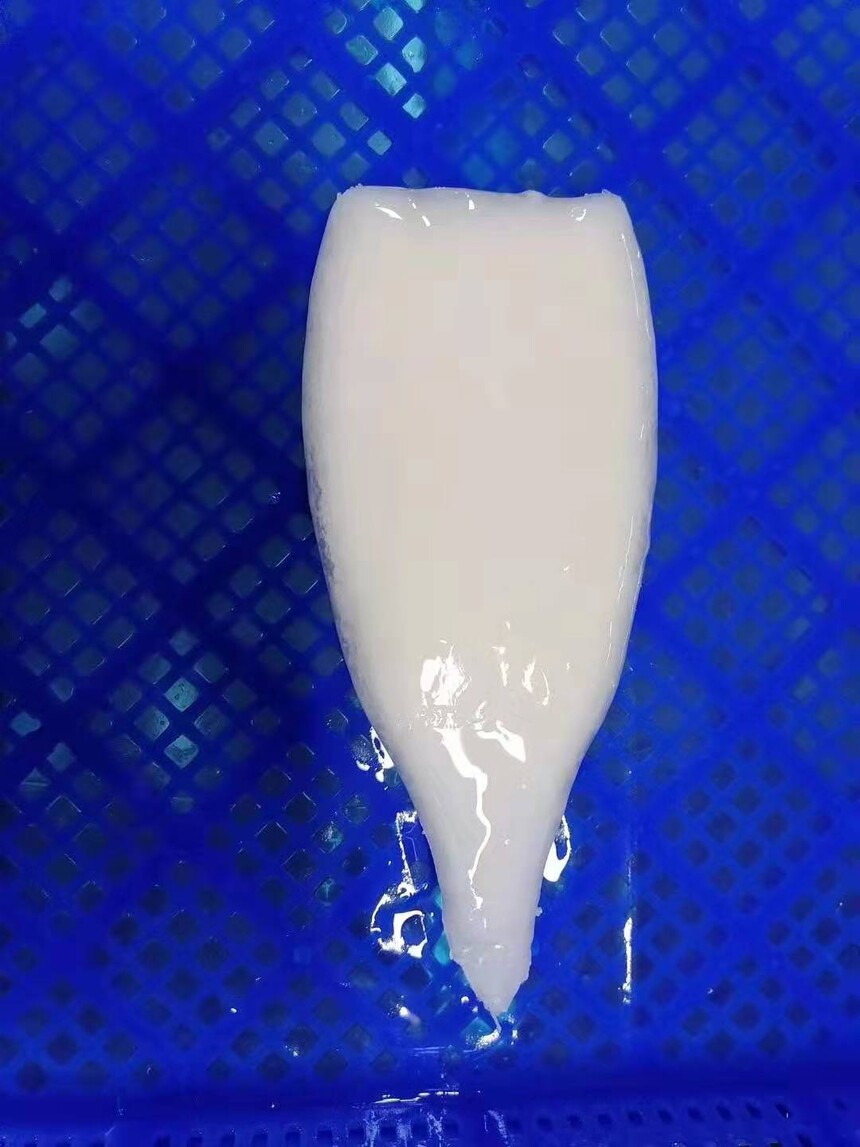

On the squid supply side, the Ministry of Production of Peru officially issued a fishing ban on June 30, suspending all fishing activities of jumbo squid (Dosidicus gigas) in its exclusive economic zone. The last batch of catches before the fishing ban has been arriving at the port one after another, and the current giant squid’s purchasing price of local freezing plants is about 2,800 soles/ton. Affected by multiple factors such as the suspension of fishing and the shortage of raw materials in factories, the industry expects that the price of giant squid raw materials will face upward pressure in the short term.

When issuing the announcement, the Peruvian government emphasized that the fishing quota (304,000 tons) from January 2025 to now has been completed in advance. Overfishing will pose risks to resource recovery and next year's fishing season of squid. It requires all shipowners, fishermen and associations to jointly abide by the ban and cooperate with resource protection measures.

Price Decline in the Southwest Atlantic: Phased Imbalance Between squid Supply and Demand

In the 27th week, the total trading volume of Southwest Atlantic squid (offshore) at the Zhejiang Agricultural Products Trade Center reached 787 tons, with an average settlement price of approximately 34,389 yuan/ton. Prices of most specifications fell, with declines ranging from 300 yuan to 1,400 yuan per ton. Among them, the price of the 100-150g specification dropped the most, by 1,402 yuan/ton, while prices of large-sized squid products over 300g also decreased by 600-700 yuan/ton.

Nevertheless, comprehensive market quotations show that expectations of both squid buyers and sellers have not changed significantly. Some downstream squid manufacturers remain in a wait-and-see attitude, and the short-term market may be in a state of seesaw between supply and demand.

According to data from Argentina's Fisheries Planning Directorate (DPP), the total landing volume of Argentine Illex squid in 2025 has reached 203,956 tons, a 33% increase compared to the same period in 2024, hitting a new high in nearly 30 years. On July 1st, China's voluntary fishing moratorium in the high seas of the Southwest Atlantic officially kicked off. Some fishing vessels have begun to relocate or return to ports, and the supply of spot goods is expected to tighten in the later period, which may provide certain support for prices.

Market Dynamics and Outlook

In terms of domestic customs clearance, the volume of self-caught squid entering Zhoushan port has achieved a month-on-month growth for the second consecutive week. Although the total volume is still at a low level, it shows a positive recovery trend.

On July 3rd, the China Overseas Fisheries Association held a conference in Taiyuan to promote regional fisheries management policies in the South and North Pacific. It clearly required enterprises to strictly abide by the regulations of international fishery organizations and promote the standardized and sustainable development of distant-water fisheries. The conference emphasized the need to "abide by rules, hold the bottom line, safeguard achievements, and protect interests," hoping that all parties will coordinate and cooperate to ensure the stability and enhancement of China's voice in global squid fishing.

Overall, China's current squid market is in a stage of supply-demand rebalancing. Prices in the Southeast Pacific are stabilizing, while the Southwest Atlantic is facing short-term adjustment pressures due to phased return shipments and increased imports.

Looking ahead, if Peru and Argentina enter medium-to-long-term fishing moratoriums while China's high-seas fishing vessels implement synchronous fishing moratoriums, it may push the squid market into a new cycle of price fluctuations. Enterprises should closely monitor changes in origin policies, fishing dynamics, and port arrivals, formulate scientific procurement strategies, and seize market opportunities.

|